Develop and improve a Market & Competitive Intelligence function

Improving a Market & Competitive Intelligence Function

Someone in your organization decided to start a Market & Competitive Intelligence or Market Analysis function to improve market oriented decisions. This often happens (hopefully) when organizations grow more complex and bigger.

However, as the newly acquired capabilities start delivering value many managers struggle to define the next development steps.

Don’t develop it further and you will frustrate everyone involved within the intelligence value chain. The function will remain a dwarf and eventually decay.

Or invest in step changes to add skill and automate processes to gradually improve output and impact. But this can disrupt larger parts of the organization.

This article describes a systematic process to audit a Market & Competitive Intelligence function (also often referred to as Market & Competitive Intelligence or Market Analysis) and to set it up to become an invaluable decision making hotbed for decision makers across the organization.

If you are a manager who expects more from the Market & Competitive Intelligence function in future or a MI manager with ambitions to add more value, you might find this useful.

It works. But now what?

Congratulations, as a forward looking and market oriented business unit head or executive team member you installed some initial capabilities for market research and competitive analysis.

The person in charge provides reports, web snippets with some commentary and everyone spends a bit less time with “Aunt Google”.

So far, so basic.

After a year or so in service the Market & Competitive Intelligence manager and her stakeholders want to know where to take it from here:

The Market & Competitive Intelligence manager wants to further educate herself and add deliverables to add even more value. She is waiting for additional direction and support. While her service becomes better known internally, allocating her resources in the most beneficial manner is a challenge.

Sales and Business Development are wondering whether they can outsource some of their market and customer intelligence work to her but struggle to separate work packages in a sensible way. Plus: perceived loss of control is an issue.

Leaders start asking questions as to what value the new position provides and how it can deliver even more. Some of their inquiries are vague though, others don’t even seem to add a lot of value.

Several managers claim not to be in need of market insights from a third person as they have ‘always understood their market themselves’.

And there are the doubters (you always have them) who wouldn’t have set up the Market & Competitive Intelligence position in the first place. Can you say ‘not invented here’ syndrome.

At this juncture a decision needs to be made to drop or develop the function. But who is knowledgable enough how to progress a Market & Competitive Intelligence function when there wasn’t even one a year ago?

The Market & Competitive Intelligence manager is still at the early stages of her learning curve. The other departments and management won’t have time and the experience.

Do it yourself or hire the skill

For the ambitious Market & Competitive Intelligence manager or a business excellence expert the following steps should be fairly simple to replicate.

Review current solutions (function self-assessment)

Conduct stakeholder survey and establish dialogue

Find alignment with internal processes and strategic planning

Propose best practice excellence

Analyze gaps and develop future options

Properly manage improvement projects portfolio

But how do you work through these steps when this is all new to you?

If you have experienced planners and business excellence folks within your ranks, the following process and structure are straight forward for them.

In order to move the assessments and analysis forward DMAIC, a data-driven improvement process, is used:

DMAIC is an abbreviation of the five improvement steps it comprises:

Define - Problem, goal, scope

Measure - Baseline, what is measured how

Analyze - Find root cause, opportunity

Improve - Identify and implement solution

Control - Sustain gains

If you don’t have the time and skill or you want to particularly use a set of external eyes to challenge the status quo and to instill excellence you can hire a specialized marketing consultant to use this or a similar process.

Work it out

1. Review current solutions and needs (function self-assessment)

Nobody knows the Market & Competitive Intelligence function better than the people running it. Any development needs a baseline, a starting point that can also be clearly communicated to decision makers.

The most significant success factors of a business function are:

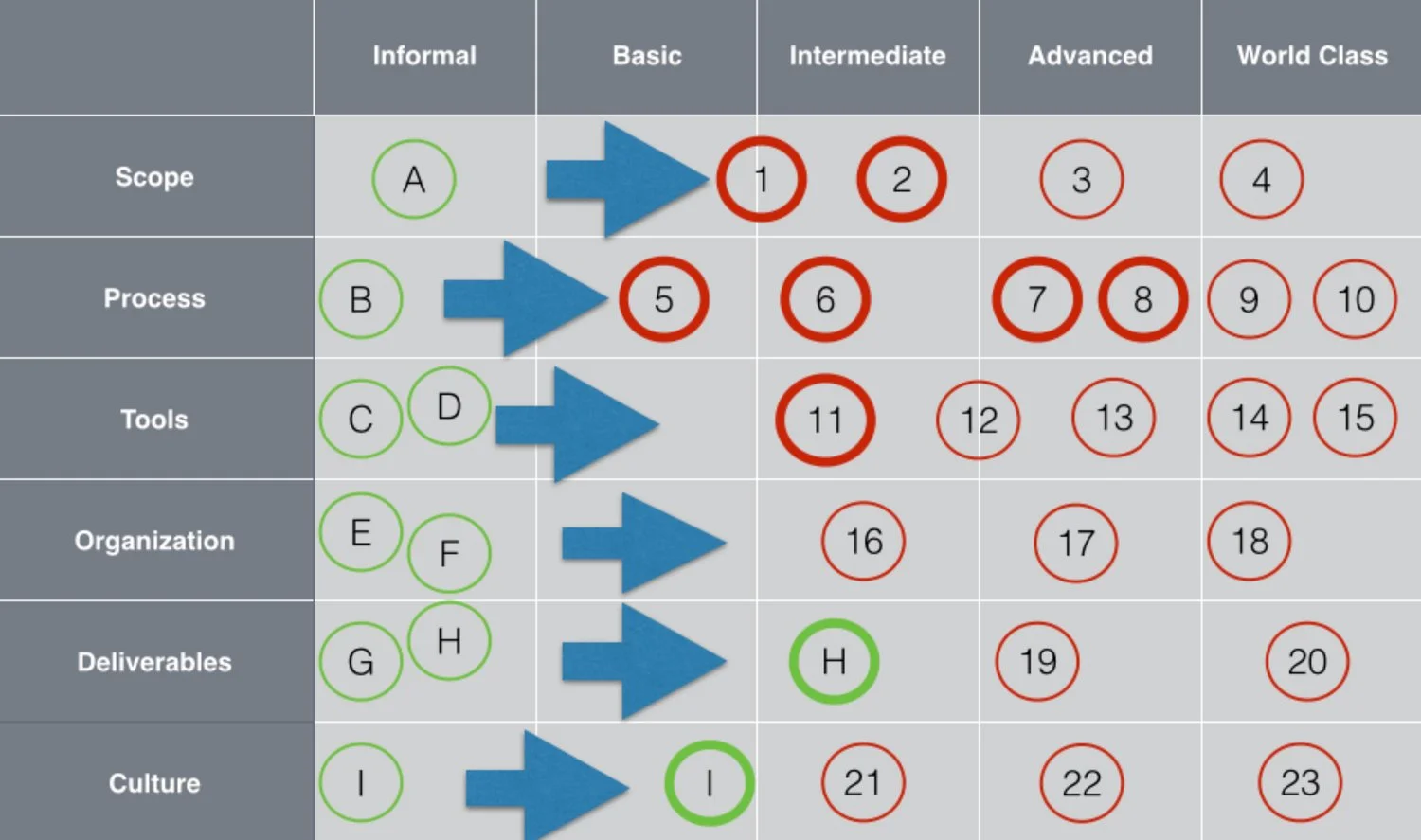

Scope

Organization

Processes

Tools

Deliverables

Culture

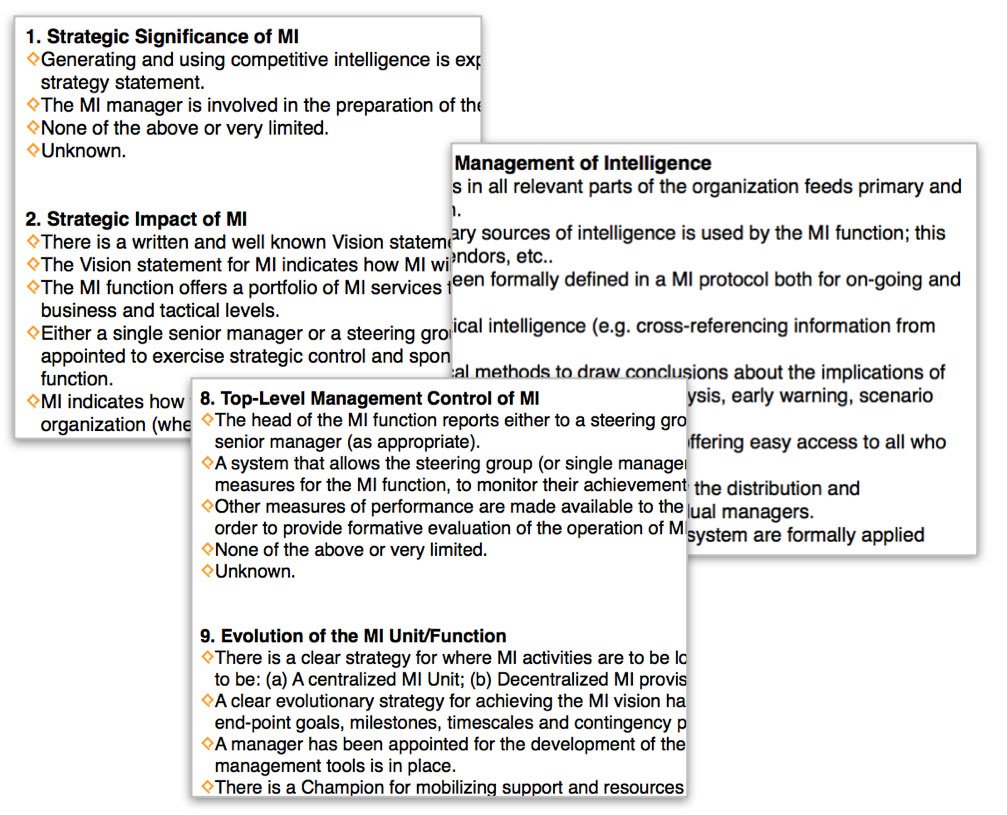

With a set of questions relating to these key success factors the Market & Competitive Intelligence manager can easily determine the current state.

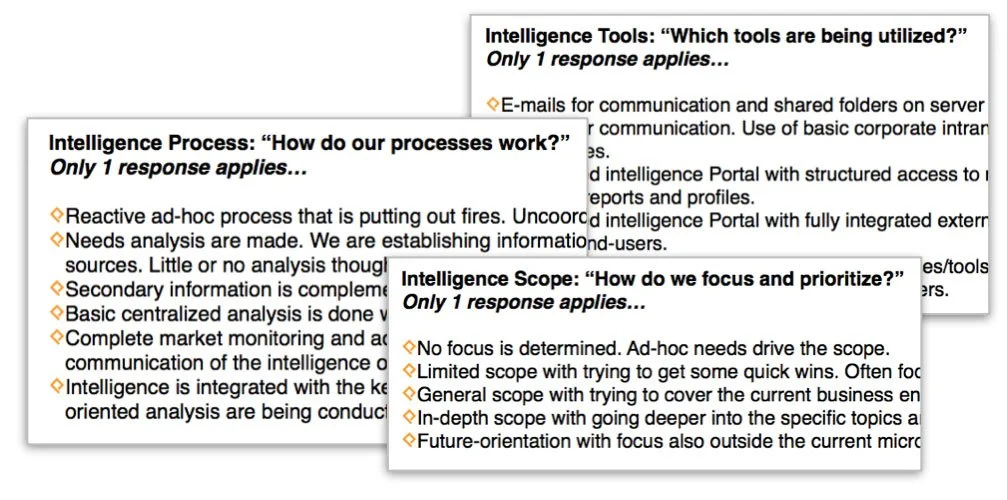

The results can be plotted into a simple matrix to show a starting point for a roadmap.

The description of the currently entertained options and how they are positioned in the roadmap determines the base line and sets the stage for further development.

It is recommended to conduct this survey face-to-face in an open dialogue to maximize the learnings and mutual understanding. It should indicate the beginning of a dialogue culture between intelligence requestor and the Market & Competitive Intelligence manager.

It bears repeating that any intelligence deliverable can only be as good as the combined quality of the briefing and the dialogue throughout the development phase of the intelligence piece. Hence, a culture of dialogue is paramount for the further improvement of the Market & Competitive Intelligence function.

The feedback from the stakeholders should also be used to challenge the self-assessment and adjust the status quo image (the roadmap matrix from before).

Here as well, if you feel more comfortable to have this process run by an external expert for acceptance and experience reasons, contact a consultant you trust.

3. Find alignment with internal processes and strategic planning

By now there will be a list with a number of needs and wishes that the Market Intelligence function does not yet serve. In addition several current activities might not be well enough aligned internally.

This should all have resulted from the survey and self-assessment.

It is now time to understand how decision makers use insights that are developed by Market Intelligence. In order to anticipate workflows regardless of the organization design the following 7 marketing categories can provide some structure:

Marketing Strategy & Go-to-Market Planning

Marketing Communication & Campaigns

Brand Strategy, Protection & Management

Sales & Leads Support

Customer Focus & Retention

Corporate Communications & Image

Marketing Function & Impact

A detailed review of the activities within those 7 marketing categories should revolve around the potential need of decision support through Market & Competitive Intelligence.

The dialogue with the process owners and function leaders is another great opportunity to understand the decision processes and blindspots that can be resolved through market insights and competitive and market analysis.

To name a few classic business processes, in need of market insight and competitive intelligence, that should reside within these 7 marketing categories and that will need decision support:

Growth drivers, value propositions, customer acquisition process, prospecting, targeting, customer complaints, lost bid analysis, strategy processes, strategic planning, war gaming, scenarios, trade show process, lead management.

This review will provide further improvement potential and increase the stakeholder’s wish list.

4. Compare with best practice excellence

To recap, what we will know at this point in time:

Which insights are provided by Market & Competitive Intelligence today for which decisions?

What are further needs that are not satisfied yet?

How are decisions driven through the organization?

Which of these decision making processes can use additional insights?

There is only one element missing before a proper gap analysis can be completed: best practice examples of advanced Market & Competitive Intelligence functions.

Here are some opportunities to gather best practice from the outside:

Through associations like SCIP:org

Through business literature

Through direct contact with Market & Competitive Intelligence practitioners

Through specialized, experienced consultancies

In order to be comparable it makes sense to focus on the aforementioned key success factors when studying and analyzing the external best practice examples, you remember:

Scope

Organization

Processes

Tools

Deliverables

Culture

If possible you could review a couple more advanced industry players like competitors or partners for their Market & Competitive Intelligence capabilities as it would be highly relevant and trustworthy to debate those examples internally.

5. Analyze gaps and develop future options

The long list will certainly feature way more options and opportunities than can be handled within a reasonable time period.

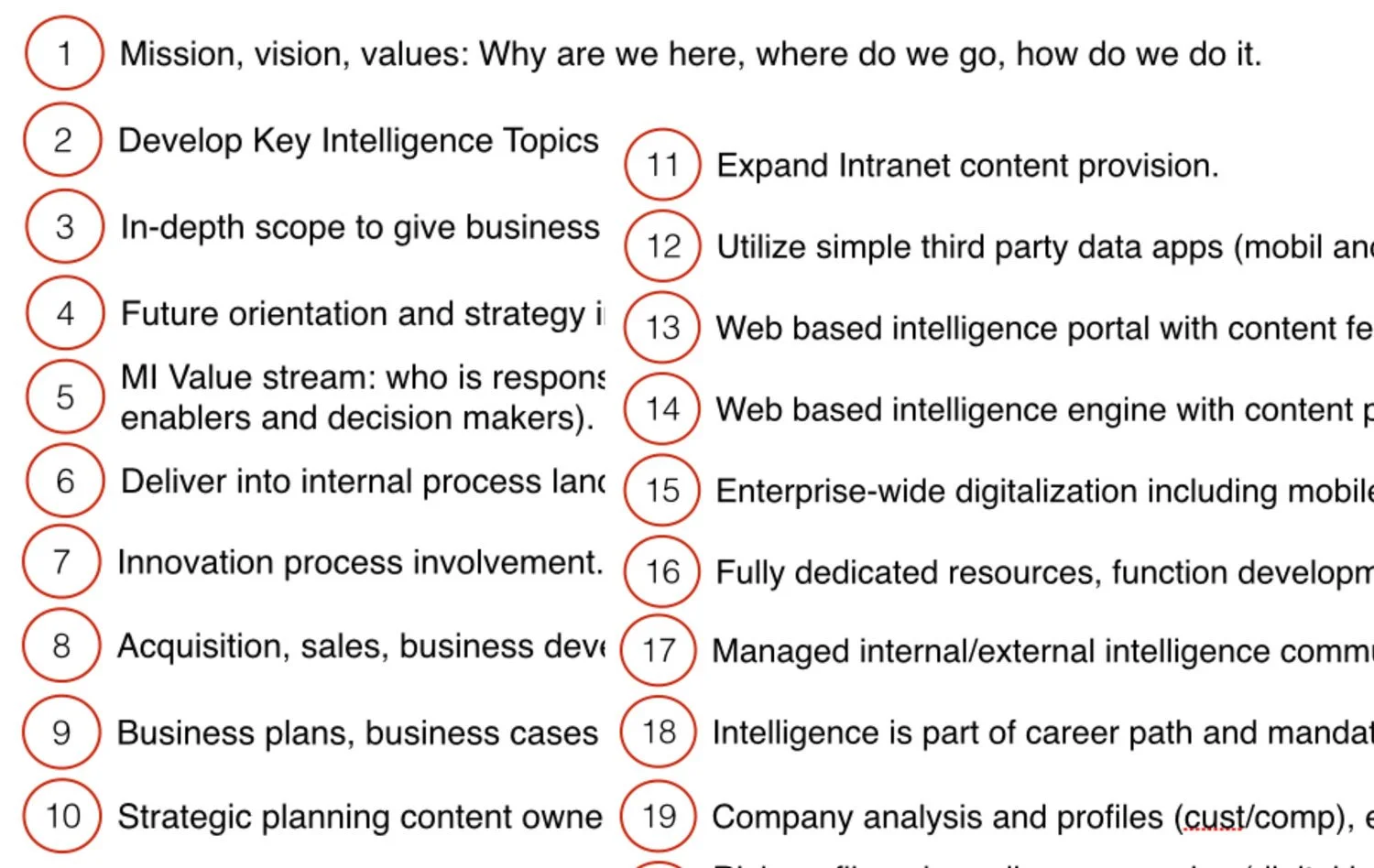

As you have become familiar with the roadmap maturity principles (see: “From Firefighters to Futurists”, Competitive Intelligence Magazine CIM Article Jan/Feb 2010, Hedin/Thieme) it should be easy to plot the best practice options into the roadmap according to their corresponding maturity stage.

Decision time

There should be all elements available now to support a decision how to develop the Market Intelligence function further:

Which insights are provided by Market & Competitive Intelligence today for which decisions?

What are further needs that are not satisfied yet?

How are decisions driven through the organization?

Which of these decision making processes can use additional insights?

Which proven best practice options are available?

Management can now review the findings, understand the gaps and the options and decide which ones to activate with priority (darker bubbles in the roadmap).

6. Properly manage improvement projects portfolio

The roadmap is now your one-pager mandate to develop the Market & Competitive Intelligence function. There will be incremental improvements (including strengthening already established solutions, see ‘I’ and ‘H’) and new solutions and processes to be set up.

It is advantageous to assign sponsors to the improvement projects. Preferably future users.

Next to a proper project management with progress report, change management should be given extra attention as tasks will be re-assigned, resources will be needed to execute the improvement projects and some collaboration and responsibilities will likely change.

But most importantly to stimulate the appetite for the solutions to come:

The assigned sponsors should act as ambassadors for the improvement projects and the Market & Competitive Intelligence function as such by enthusiastically showcasing the benefits of the agreed improvements.

Periodic health checks and adjustments complete the self-learning and improvement cycle and continuously feed the improvement engine.

*Jens Thieme is a global B2B marketing professional, sharing his practical marketing experience, this marketing glossary and b2b marketing best practice examples.