Competitor analysis example: Marketing mix at work for LIVE industry analysis

Conference and trade show competitive intelligence

Industry analysis uses secondary research and primary research data from market research companies. While most of that data is invaluable for competitor analysis and market planning it might also lack context to current affairs and blindspots.

Trade shows, business conferences and industry conventions are the single most places where the entire marketing mix (product, price, place, promotion) is accessible.

Customers, competitors, technologies and suppliers meet - and observe each other. When people observe they gather data, information and competitive intelligence. Isn’t that the same as any market research company does for a steep fee?

But how do you get sales managers and business developers excited for your own primary research and data gathering campaign?

No frills marketing tactics

Isn’t the marketing budget for trade shows, business conferences and industry conventions the largest marketing investment? Anybody within the company should be interested to maximize the impact of these marketing mix business events.

So, while everybody is at it and the cost to ship commercial folks to that business event is already spent, why not utilizing the availability of all marketing mix elements and all commercial actors to support the otherwise expensive competitor analysis and market planning needs?

But it needs to be simple and effective for commercial folks to join in. The trade show intelligence tool kit below is a proven marketing tool set to support competitor analysis and strategic market planning.

Blindspots and friends

It is always easier to convince stakeholders by example. Especially when it comes from within. There must be a formerly successful competitor analysis example anywhere in the market planning cycle in the past.

As this success story is undoubtedly attached to someone who “cashed in” on that success story - he might just be ready and hungry for more fame.

This manager might also very much dislike some current competitive blindspots. There are always some!

The combination of a former success story where a competitive threat was fenced off through a competition analysis for example - with a headache that follows that same manager day in and day out can be very powerful in convincing the sales team to support an extra primary research effort at a trade show, business conference or industry convention.

With that sponsor, acting as the event owner, driving the process and a marketing lead running the show the following simple tables should help to answer these questions:

Which major competitive blindspots to we want to resolve?

How and where do we engage with the market participants?

How do we behave ethically and legally sound?

So what?! Did we eliminate the blindspots? What are our actions now?

You can copy/paste the rest of this article for a pilot

Three months prior to the trade show or business convention an internal “event owner” is assigned (sales or business development or other commercial responsibility). This person is the overall challenger of main purpose, participation, activities roster and the decision maker for the facilitators such as marketing communications and competitive intelligence.

A competitive intelligence consultant is also assigned to own the trade show intelligence activities including preparations, pre-conference meetings and war room on site as well as wrap up and action plans that follow the market and competitive intelligence gathering.

Regardless of the number of participants in any competitive intelligence gathering activity one major pre-requisite is the clear identification of business-owned Key Intelligence Topics (intelligence requirements or KIT’s).

In preparing the event, the KIT’s owner is required to stress priorities, on-site events and companies to visit at their trade show booths and minimum intelligence that needs to be gathered to derive valid competitive insights from.

Anyone new to the practice of trade show competitive intelligence gathering should be instructed prior to the trade show including legal and ethical conduct.

Play by the rules

Legal rules in competitive business environments are regulated on a regional level and via most organization’s code of conduct. Please involve your legal department or local advisor in your plans to extract competition intelligence from a trade show or business convention.

In gathering input for the KITs any interviewer needs to reveal their identity and purpose of questioning if asked to. Disguising one’s true identity and intentions can be considered illegal and might result in severe anti-trust penalties and reputation damage.

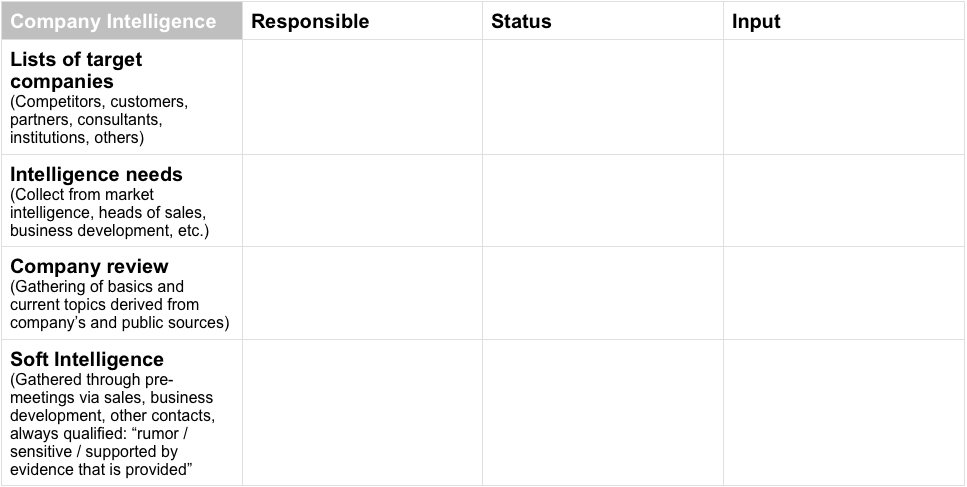

Pre-Show Preparation Competitor Intelligence

The success of extracting valuable competitive intelligence from any trade show or conference largely depends on a solid preparation and resource planning. From the following options pick the most important for your tasks and either assign less urgent or important activities to other staff or skip them altogether.

The event owner requests all necessary official event documents such as program, floor maps and booth plans, contacts, etc. and assembles a trade show core team consisting of marketing communication, sales, business development and market intelligence representatives.

The event owner also sets priorities to the content and activities that are deemed redundant or non-value adding for that particular event.

Who is responsible for what?

Key Intelligence Topics need to be defined prior to interviews, use separate form to collect these.

Key Intelligence Topics need to be defined prior to interviews, use separate form to collect these.

Tasks distribution and information flow

For maximum efficiency various preparations need to be in place such as access to locations. Defining feedback loops and information flow secure the utilization of extracted competitive intelligence.

Time distribution

In your preparation efforts and in order to maximize marketing ROI at the trade show feel free to create a time distribution sheet which can raise your efficiency awareness.

Hours or weight as a graphical symbol per activity

Intelligence gathering / Interview checklists (use one per interview)

The collection of information, competitive intelligence needs to be based on Key Intelligence Topics (intelligence requirements) defined by competitor, customer or topic (see separate form).

*competitor, customer, supplier, partner, association, official, government, show staff

**friendly, hostile, suspicious, trust worthy, grape wine, etc.

Obviously this competitor analysis example can and should be adjusted to individual needs.

Industry analysis and competitor analysis can not only support market planning but effectively remove competitive blindspots and thus support strategic decision making.

Jens Thieme is a global B2B marketing professional, sharing his practical marketing experience, this marketing glossary and b2b marketing best practice examples.